School finance consultant, John Cannon compares commercial packages with school-specific software

There are many accounting packages available today designed for use in commercial environments. We, as finance people, are familiar with the names and big players in the market, and they are very successful at what they do.

However, their systems do not suit the fee-paying schools’ needs. Why is this?

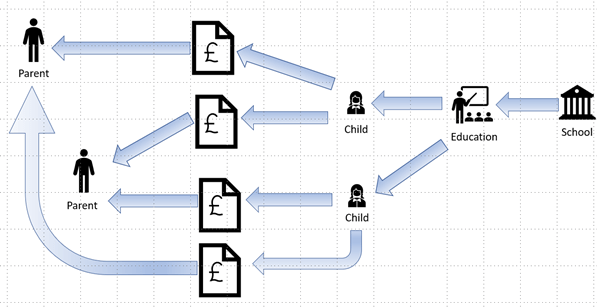

The pupil/parent relationship

In a commercial environment there is a simple relationship in that a product or service is being sold to a customer.

In the school’s environment this is vastly different. Schools are centred around pupils. So, in a straightforward relationship we have a school providing a service (education) to a child that is paid for by a parent/bill payer.

The commercial system has no concept of the child, just the parent or bill payer.

Further complications arise when the bill is split between multiple payers. It might be because an employer pays the fees, a family arrangement, or where parents have separated and are jointly funding their child’s education.

As commercial systems do not have the concept of a child, they are unable to automatically calculate the split for the bill.

A specialist billing system such as that in WCBS’ passFINANCE and Cloud Finance will do this for you on pre-defined parameters that say who needs to pay what. A single fee or charge can be split amongst those designated as paying the bill. This saves countless hours of calculating who pays what on a bill and going through the long-winded task of then generating these bills individually. For schools who bill termly, simply multiply this scenario by three!

Credit control

Generating the bills is just one aspect of the process affected by the pupil/parent relationship; we also need to consider how the debt is then managed for credit control purposes. In a commercial environment this is straightforward – we are dealing with just one customer in many cases.

The simplest relationship in a school is where one parent pays the bill, but still, the pupil is an extra dimension.

Schools need to consider even further when multiple people pay the bill, how the debt should be viewed.

Balances should be available at parent level and child level. For a £6,000 bill split 50/50 between two bill payers, each parent will have a debt of £3,000 and the total amount outstanding for the child would be £6,000.

Specialist billing software allows the school to view outstanding amounts from the child’s perspective, i.e. how much is owed in respect of that child and the bill payer’s perspective, i.e. how much does that individual or organisation owe to the school.

Commercial software does not facilitate this.

Now, add to the scenario multiple bill payers and multiple children per bill payer(s), and reports on aged debtors become a real challenge using commercial software. It is important to accommodate these relationships, because a bill payer could pay for more than one child, and any issues arising may be related to the bill payer’s ability to pay in general, or just be a dispute on the one bill payer/child relationship.

The ease of access to data and the management of the unique relationships seen in schools are two of the many reasons why independent fee-paying schools choose specialist software to manage billing in their schools, such as that offered by WCBS.

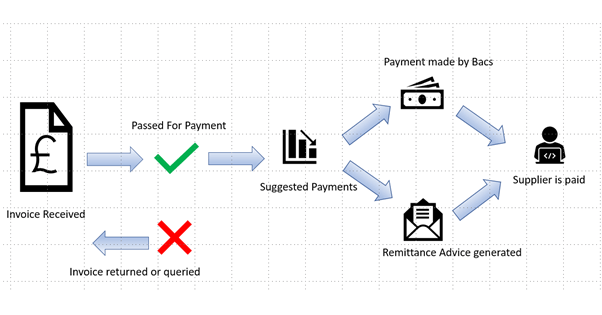

Supplier management and purchasing

Specialist software for schools can take ownership of the whole process of supplier management and purchasing. This process starts with the setting and ongoing management of budgets, through to orders being requested, authorised, goods received, invoices received, and payments made. This is done through a joined-up system with a process defined by the school for authorisations.

Invoice payment is one simple, straightforward process – once entered, invoices are authorised, and the suggested payment run picks up all due invoices that can be paid in one go. The system subsequently generates a BACS file ready for payments to be made. Audit reports are provided to ensure transaction values and totals match with minimal checking needed and no rekeying of data needed.

Nominal Ledger and financial reporting

One of the major differences between a commercial system and specialist software for schools is the posting for Nominal transactions. On a typical termly fee bill there are usually Fees in Advance, Extras in Advance, Extras in Arrears and various fees adjustments such as scholarships and bursaries.

When posting in a commercial system, there is just a one to one relationship with the periods posted into.

Specialist software will allow items to be apportioned to the period in which they belong. Standard Reports and Dashboards are provided with the system for a variety of purposes.

Reporting outside the system

Specialist software for schools can be accessed by third party tools either via an ODBC connection or using an API (application program interface). The access method is usually governed by the tool used, with examples of applications used being:

- Excel: usually for finance reports where additional calculations are needed

- Word: usually for letters and mail merge

- Power BI: in a Group scenario for combining data from several schools and adding data from other sources

- Crystal Reports: used via ODBC for creating reports.

School-specific information

Commercial systems do not tend to work well with school structures. Fields such as Year Group, Form, Tutor, etc., aren’t usually standard and additional configuration is needed.

Whilst it is perfectly feasible to configure such fields, routines to automatically move data without writing complicated scripts and programming are few and far between. The end of year process is an example of this where pupils typically move up a year group, change form, change tutor and can even change fee code.

The year transfer routine in school-specific software allows the changes to automatically happen where all pupils in Year One are put in Year Two, Year Two in Year Three, Form 2a into Form 3a, Year Six Junior Fee to Year Seven Senior Fee, etc.

Commercial systems do not have a concept of term dates either, which can cause complications with billing, end of year and other processes.

Specialist software for schools, such as WCBS’ passFINANCE and Cloud Finance, incorporates many other valuable tools not included in commercial systems.

I’m happy to discuss this all further in more detail, one to one – please contact me via email John.Cannon@wcbs.co.uk.